Annual Report

2015

|

DAYANG ENTERPRISE HOLDINGS BHD

(712243-U)

129

32. Financial instruments (cont’d)

32.3 Financial risk management (cont’d)

(c) Market risk

Market risk is the risk that changes in market prices, such as foreign exchange rates, interest

rates and other prices will affect the Group’s financial position or cash flows.

(i) Currency risk

The Group is exposed to foreign currency risk on purchases that are denominated in a

currency other than the respective functional currencies of group entities. The currencies

giving rise to this risk are primarily Singapore Dollar (SGD), United States Dollar (USD) and

Ringgit Malaysia (MYR).

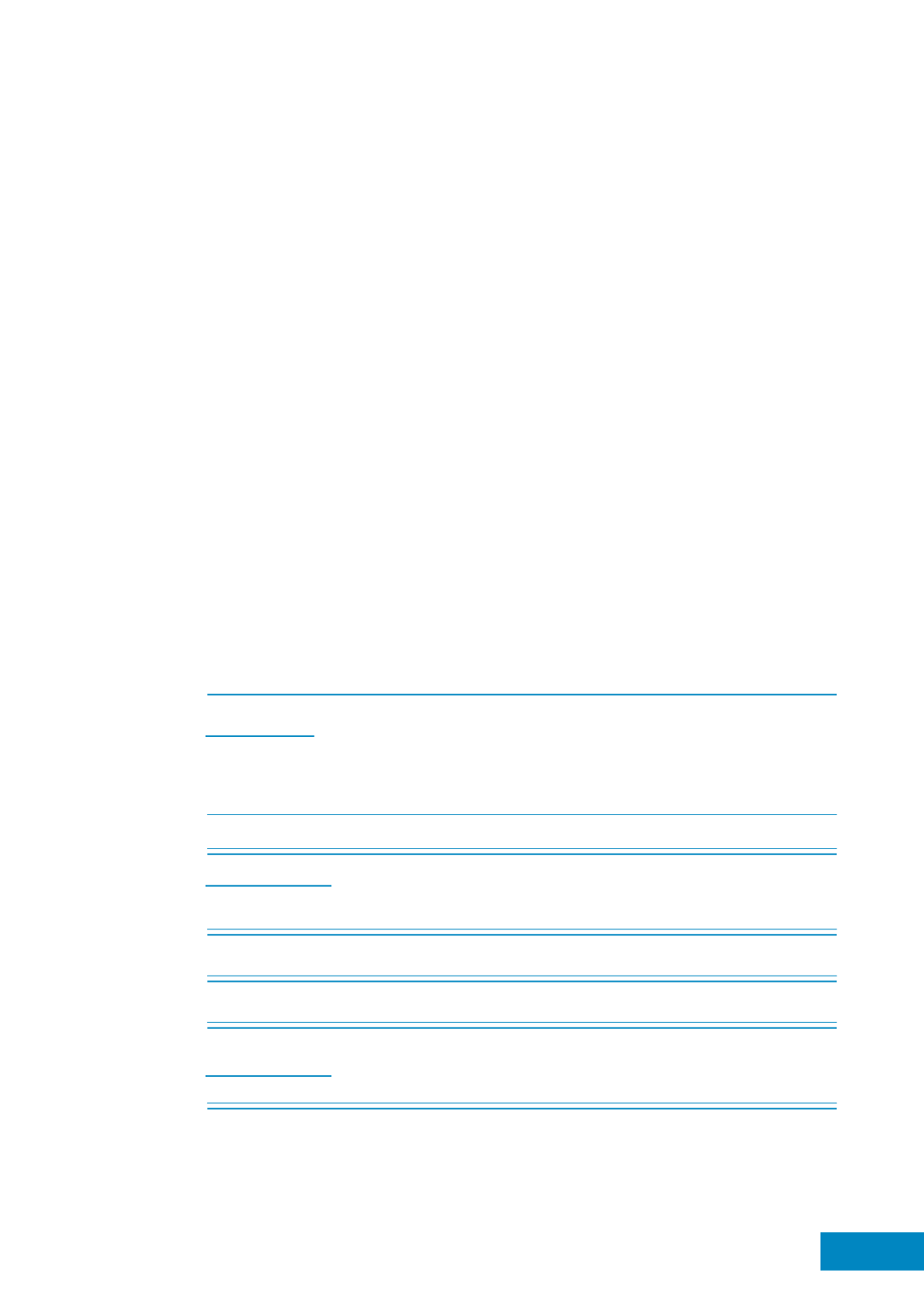

Exposure to foreign currency risk

The Group’s exposure to foreign currency risk attributable to currencies other than the

functional currencies of group entities, based on the carrying amounts as at the end of the

reporting period was:

Denominated in

USD

SGD

MYR

Group

RM

RM

RM

2015

Financial assets

Trade and other receivables

246,234

349,513

260

Deposits and prepayments

-

-

2,080

Cash and cash equivalents

4,557,491

71,355

-

Intra-group balances

-

-

60,674,428

4,803,725

420,868 60,676,768

Financial liabilities

Trade and other payable

(1,216,128) (5,359,994)

-

Intra-group balances

(42,118,333) (69,306,989)

-

(43,334,461) (74,669,983)

-

Net currency exposure

(38,530,736) (74,246,115) 60,676,768

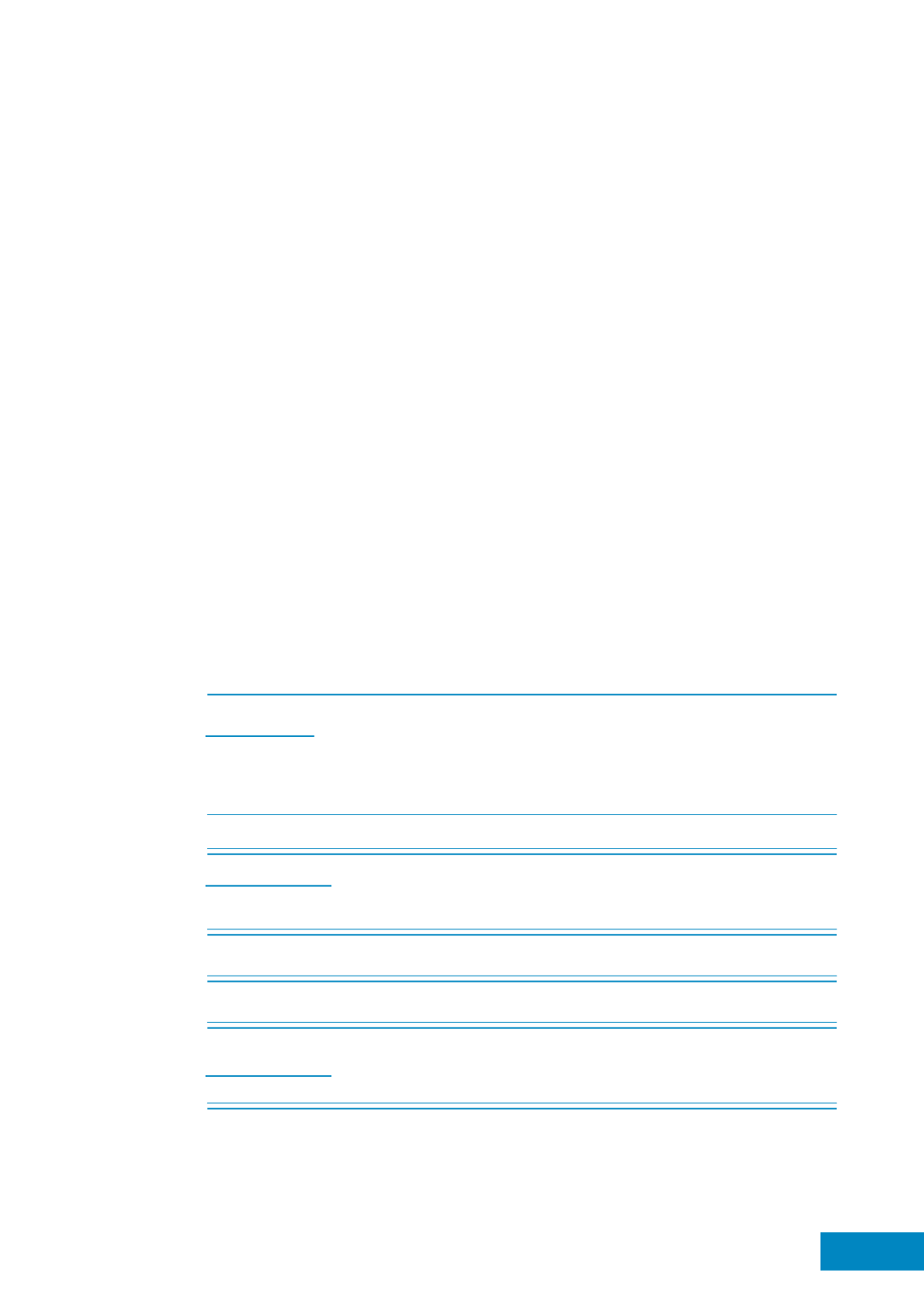

2014

Financial liabilities

Trade and other payables

(607,660)

(155,322)

-

Notes to the

Financial Statements

(cont’d)