DAYANG ENTERPRISE HOLDINGS BHD

(712243-U)

|

Annual Report

2015

130

32. Financial instruments (cont’d)

32.3 Financial risk management (cont’d)

(c) Market risk (cont’d)

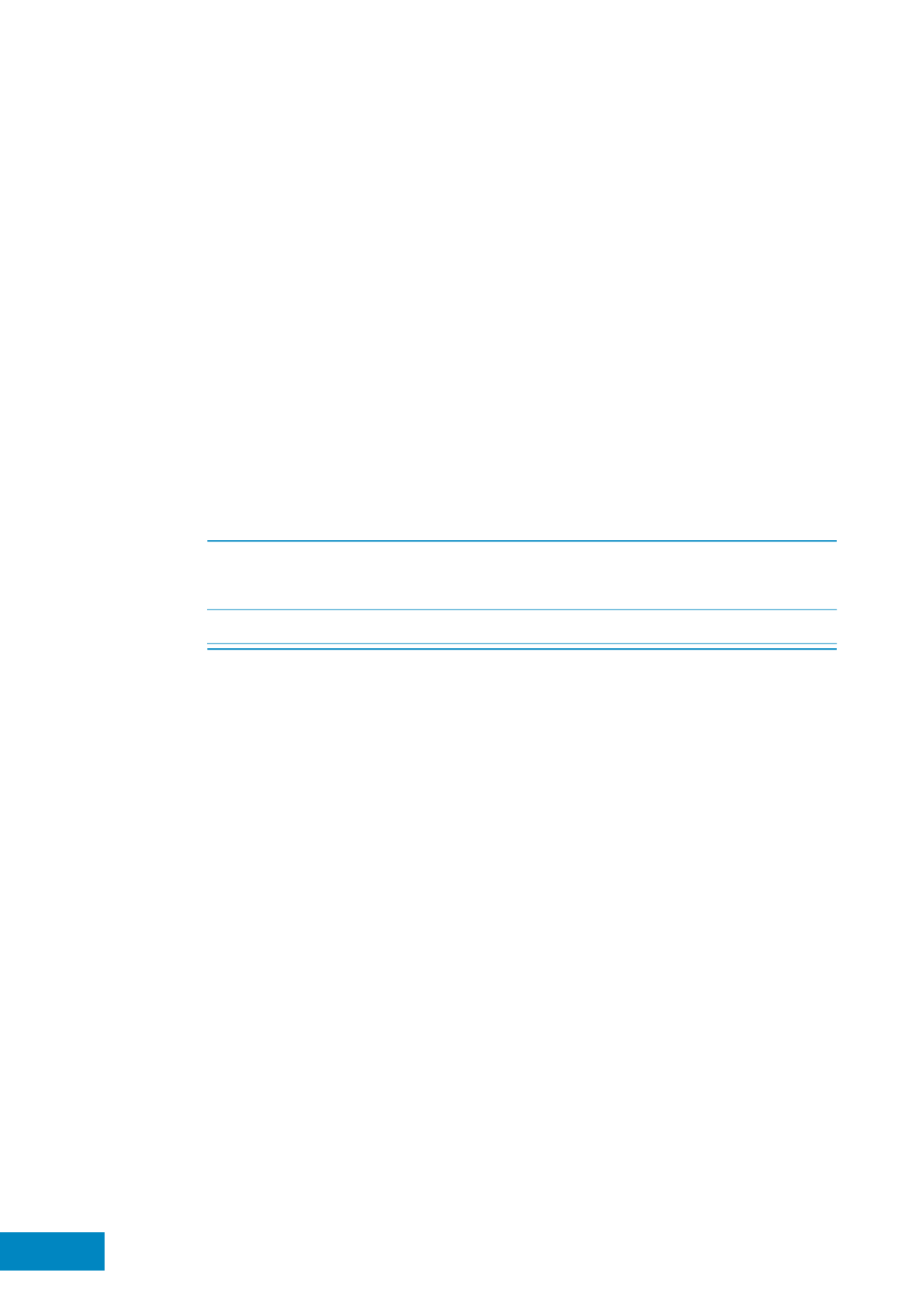

Currency risk sensivity analysis

A 10% (2014: 10%) strengthening of the RM against the following currencies at the end of

the reporting period. The analysis assumes that all other variable, in particular interest rates,

remained constant.

2015

2014

Profit

Profit

Equity

or loss

Equity

or loss

RM

RM

RM

RM

USD

3,853,074 3,853,074

60,766

60,766

SGD

7,424,612 7,424,612

15,532

15,532

MYR

(6,067,677) (6,067,677)

-

-

5,210,009 5,210,009

76,298

76,298

Currency risk sensitivity analysis

A 10% (2014: 10%) weakening of RM against the above currencies at the end of the reporting

period would have had equal but opposite effect on the above currencies to the amounts

shown above, on the basis that all other variables remained constant.

(ii) Interest rate risk

The Group’s fixed rate deposits and borrowings are exposed to a risk of change in their

fair value due to changes in interest rates. The Group’s variable rate borrowings are

exposed to a risk of change in cash flows due to changes in interest rates. Short term

other investments and short term receivables and payables are not significantly exposed

to interest rate risk.

Risk management objectives, policies and process for managing the risk

The Group monitors its exposure to changes in interest rates on a regular basis.

Borrowings are negotiated with a view to securing the best possible terms, including

interest rates, to the Group.

Notes to the

Financial Statements

(cont’d)