Annual Report

2015

|

DAYANG ENTERPRISE HOLDINGS BHD

(712243-U)

131

32. Financial instruments (cont’d)

32.3 Financial risk management (cont’d)

(c) Market risk (cont’d)

Currency risk sensitivity analysis (cont’d)

(ii) Interest rate risk (cont’d)

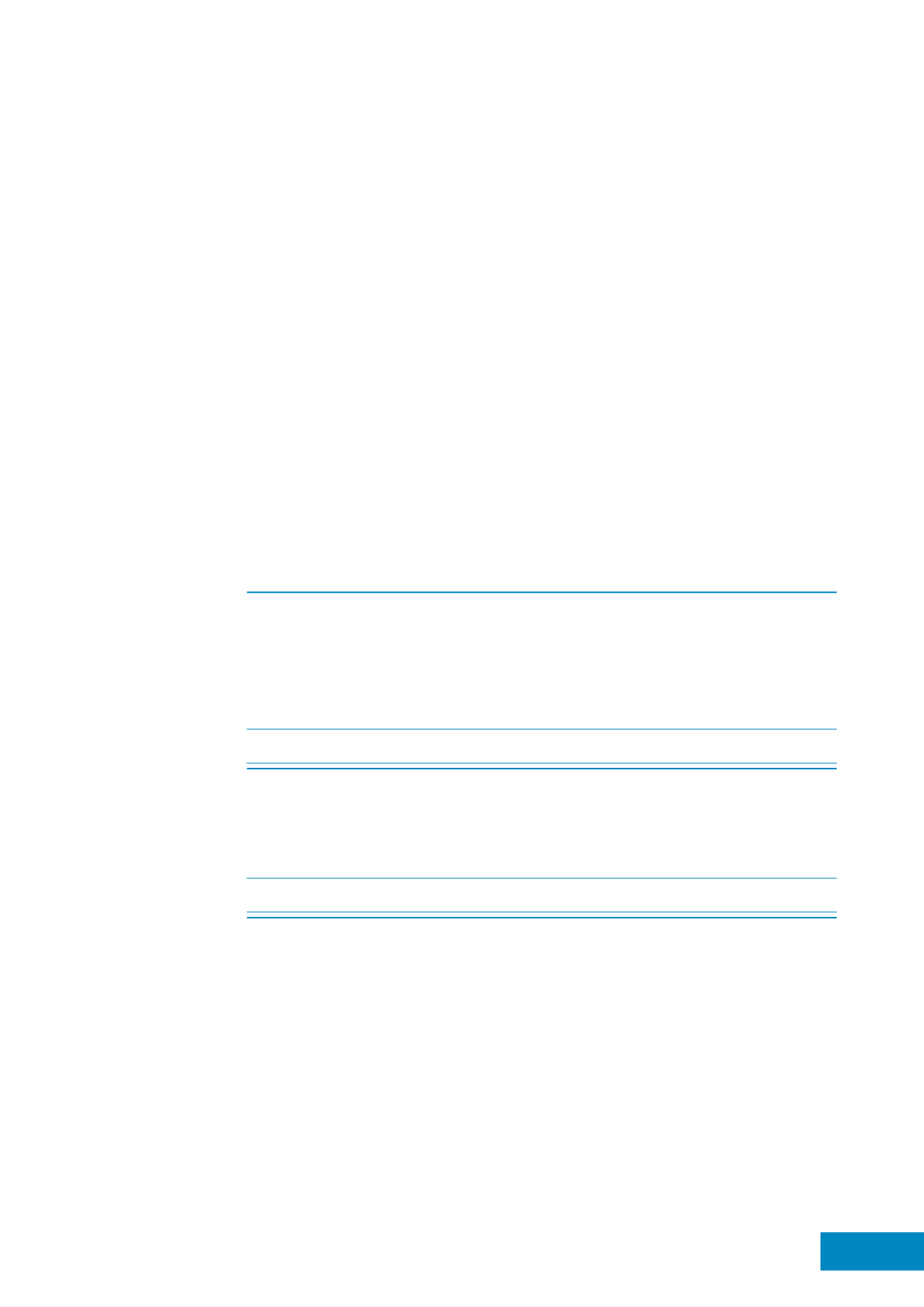

Exposure to interest rate risk

The interest rate profile of the Group’s and the Company’s significant interest-bearing

financial instruments, based on the carrying amounts as at the end of the reporting

period was:

Group

Company

2015

2014

2015

2014

RM

RM

RM

RM

Fixed rate instruments

Financial assets

- loan to a subsidiary

-

-

57,624,436 100,201,821

- deposits placed with

licensed banks

70,127,228 157,789,927

-

46,237,098

Financial liabilities

- finance lease liabilities

(303,389,494)

-

-

-

(233,262,266) 157,789,927 57,624,436 146,438,919

Floating rate instruments

Financial liabilities

- term loans

(1,431,801,678) (83,869,563) (674,391,000)

-

- revolving credits

(70,000,000) (70,000,000)

-

-

(1,501,801,678) (153,869,563) (674,391,000)

-

Interest rate risk sensitivity analysis

Fair value sensitivity analysis for fixed rate instruments

The Group does not account for any fixed rate financial assets and liabilities at fair value

through profit or loss and does not designate derivatives as hedging instruments under a

fair value hedge accounting model. Therefore, a change in interest rates at the end of

the reporting period would not affect profit or loss.

Notes to the

Financial Statements

(cont’d)