DAYANG ENTERPRISE HOLDINGS BHD

(712243-U)

|

Annual Report

2015

42

Additional Compliance

Information

as at 31 December 2015

1.

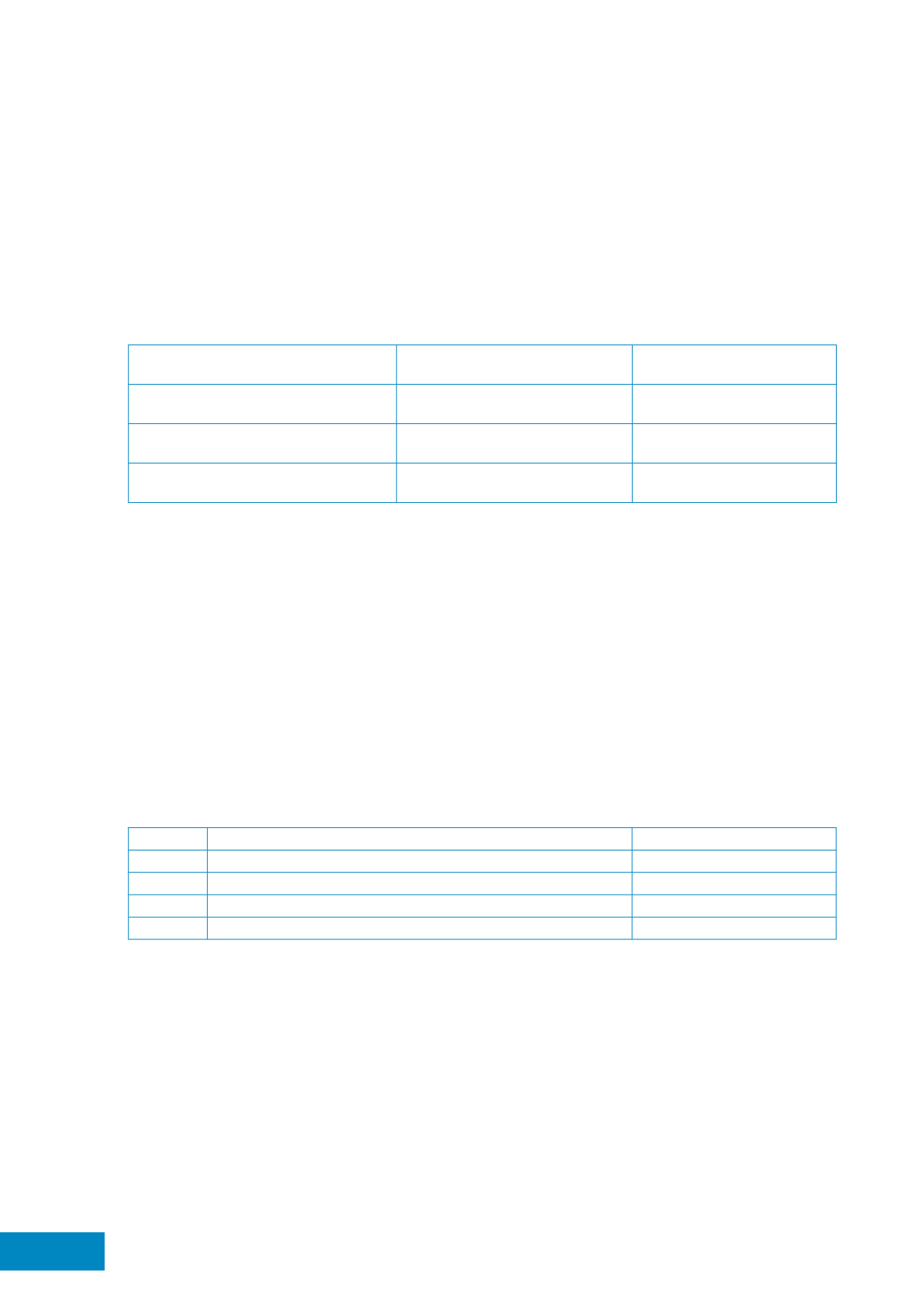

Utilization of Proceeds from Corporate Exercise

The Company had successfully placed out 52,100,000 new ordinary shares of RM0.50 each pursuant to the

Private Placement 2014 which raised a gross proceeds of approximately RM175.58 million. The status of utilization

of the proceeds as follows:

Amount raised from Private

Placement 2014 (RM’000)

Actual Utilization

(RM’000)

Working capital and/or potential

investment projects(s)

170,677

170,677

Expenses in relation to the Private

Placement

4,900

4,900

175,577

175,577

2.

Share Buy-Back

During the financial year ended 31 December 2015, no shares were bought back from the market.

3.

Options, Warrants or Convertible Securities

There were no options, warrants or convertible securities exercised in respect of the financial year.

4.

Depository Receipt Programme

The Company did not sponsor any Depository Receipt Programme during the financial year ended 31 December

2015.

5.

Imposition of Sanctions and / or Penalties

There were no public sanctions and/or penalties imposed on the Company or its subsidiaries, directors or

management by the relevant regulatory bodies during the financial year ended 31 December 2015.

6.

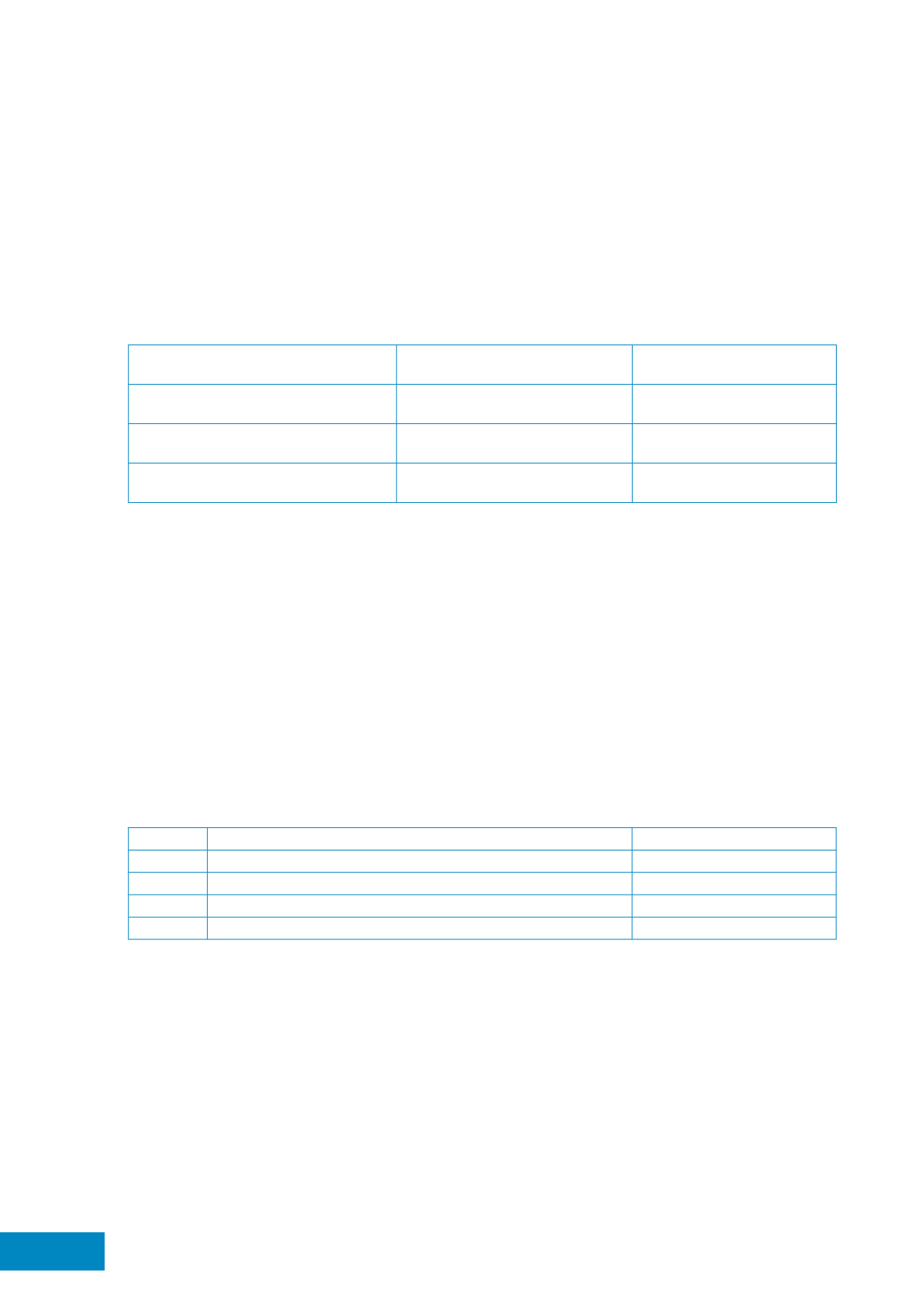

Non-Audit Fees

The amount of non-audit fees incurred for services rendered to the Company and its subsidiaries by the

Company’s auditors for the financial year ended 31 December 2015 was as follows:-

Item Nature of services rendered

RM

a.

GST Consultation fees

210,000

b.

Tax fee

57,055

c.

Other advisory fees

72,000

Total

339,055

7.

Variation in Results

There were no material variances between the audited results of the financial year ended 31 December 2015

and the unaudited results previously released by the Company.

8.

Profit Guarantee

The Company did not receive any profit guarantee during the financial year under review.

9.

Material Contracts

There were no material contracts entered into by the Company and/or its subsidiaries during the financial year

ended 31 December 2015 which involves the interests of the Directors and major shareholders.

10.

Recurrent Related Party Transactions of a Revenue or Trading Nature (“RRPTs”)

The details of RRPTs undertaken by the Group during the financial year under review are disclosed in Note 35 to

the financial statements on page 138.